Pengendalian Tunneling Dalam Asset Utilization: Sebuah Tinjauan Teoritis

DOI:

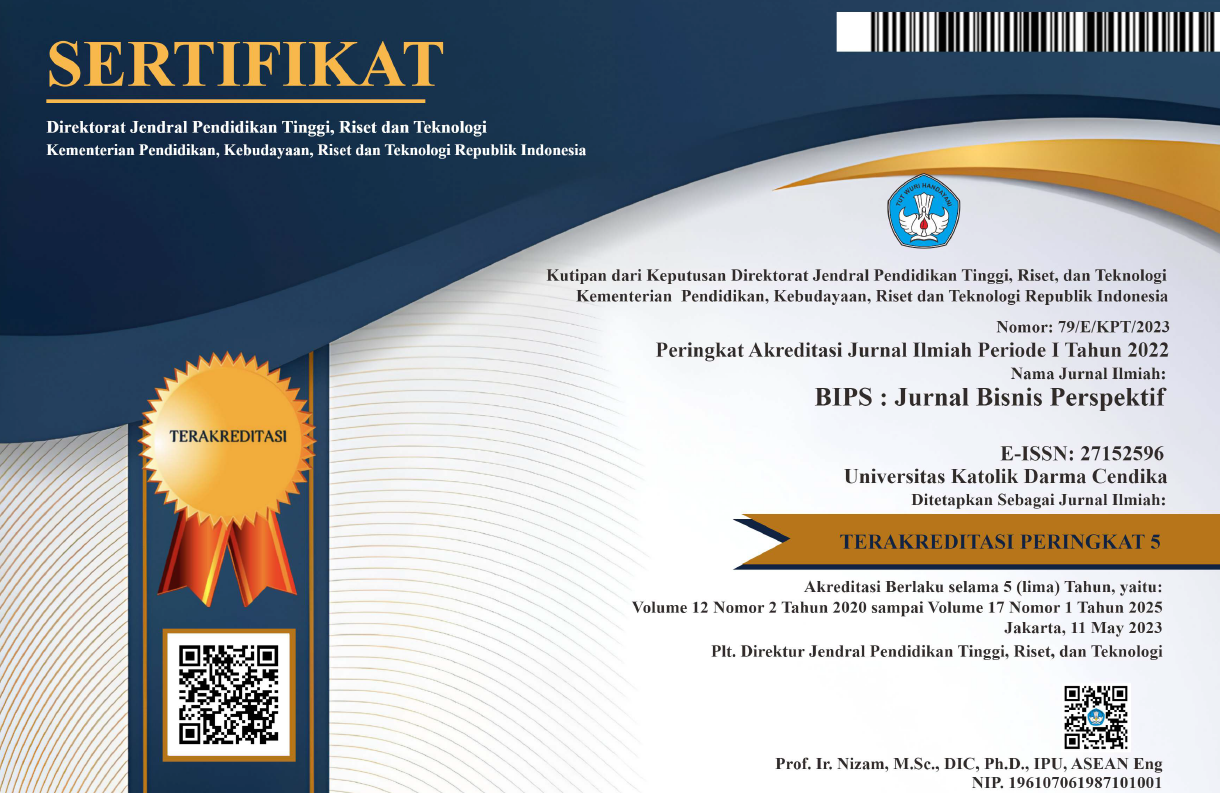

https://doi.org/10.37477/bip.v10i2.57Keywords:

tunneling, asset utilization, institutional ownership, debt policyAbstract

Johnson et al. (2000) define tunneling as the transfer of resources out of the

company for the benefit of controlling shareholders. This study will focus on institutional ownership and debt policy which will be further investigated as a control mechanism that occurs in asset utilization and has an impact on company performance. The results of the theoretical review of this study, namely institutional ownership and debt policy can control tunneling in asset utilization. Control mechanisms through institutional ownership of company performance can occur because institutional shareholders are very interested in company performance because a large portion of institutional shareholders' wealth is directly related to the company's wealth. The control is relevant to the owner because it is related to wealth that is tied to the company it owns, so that through increasing the proportion of institutional ownership it can reduce agency costs that arise, especially in the case of asset utilization of the company through supervision carried out. The control mechanism through debt policy on company performance can occur because the debt policy is carried out by the owner by transferring it to the banks or creditors to conduct supervision so as to maximize the performance of the company. The control becomes relevant because it is related to funds lent by banks or creditors to the company so that the company is expected to be able to pay interest and principal loans when due.

Downloads

Published

How to Cite

Issue

Section

License

Authors publishing in this journal agree to the following terms:

- The author retains copyright and grants the journal rights of first publication with the work simultaneously licensed under a Creative Commons Attribution ShareAlike License License that allows others to share the work with acknowledgment of the author's work and initial publication in BIP's: Journal of Business Perspectives.

- Authors may include separate additional contractual arrangements for non-exclusive distribution of the published version of the journal (e.g., submit to an institutional repository or publish in a book), with an acknowledgment of the original publication in this Journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their websites) before and during the submission process, as it can lead to productive exchanges, as well as citations of previously published work.

Each author is expected to complete the copyright process with a document of the originality of the manuscript, the templated document is below:

7.png)

6.png)

2.png)