Analisis Pengaruh Kebijakan Utang, Kepemilikan Saham Publik, Risiko Kebangkrutan Terhadap Biaya Agency

DOI:

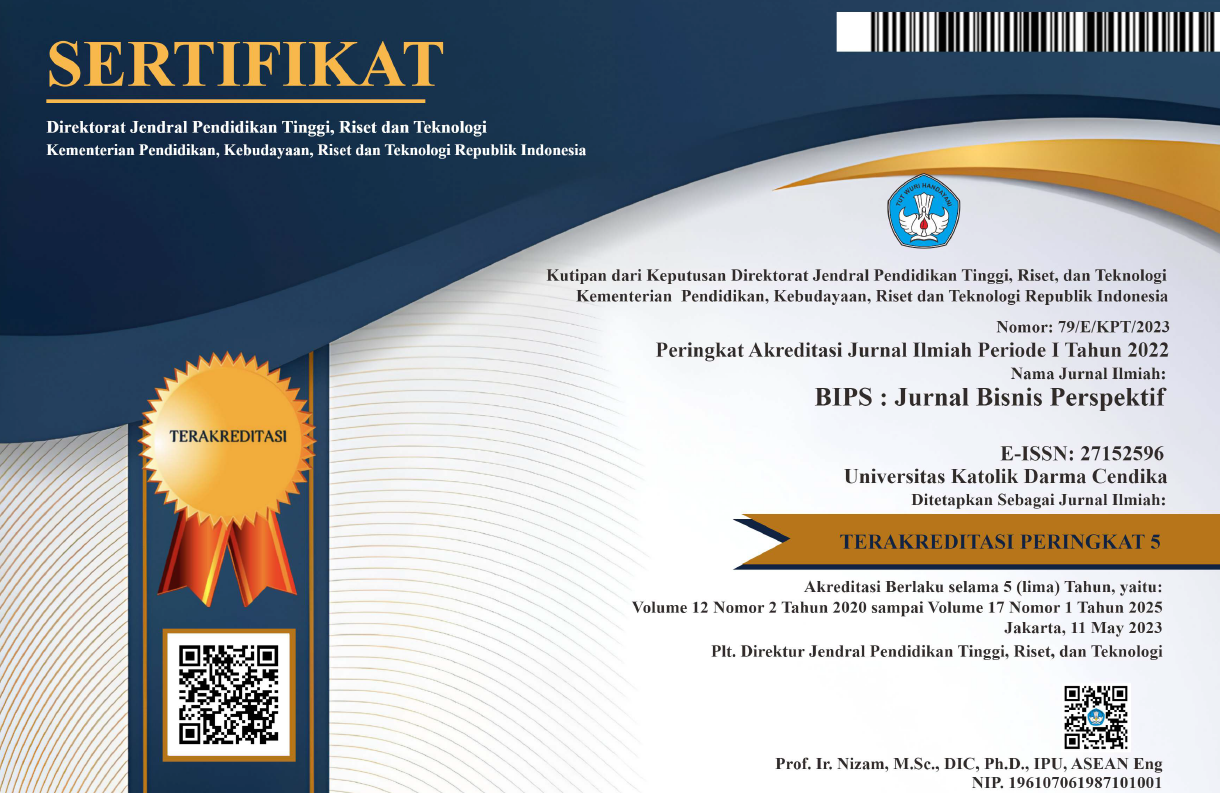

https://doi.org/10.37477/bip.v8i2.8Keywords:

debt ratio; managerial ownership; agency costAbstract

Financial management strategic decision that can not be ignored is the decision regarding the dividend policy, investment, and financing, are closely associated with the company's goal is to optimize the value of the company. However, the goals are often not carried out in connection with the separation of the functions of ownership and management functions of the company, which makes the manager to act independently and not in line with company objectives. Conflicts over the source of the problem that causes the cost of the agency (agency cost), ie all costs incurred to carry out surveillance (monitoring) on the performance of managers. The research objective was to determine whether the debt ratio, managerial ownership, and earnings volatility significantly affect the cost of agency. Results showed that the ratio of debt, stock ownership by top managers, and earnings volatility significantly not affect the cost of agency.

Downloads

Published

How to Cite

Issue

Section

License

Authors publishing in this journal agree to the following terms:

- The author retains copyright and grants the journal rights of first publication with the work simultaneously licensed under a Creative Commons Attribution ShareAlike License License that allows others to share the work with acknowledgment of the author's work and initial publication in BIP's: Journal of Business Perspectives.

- Authors may include separate additional contractual arrangements for non-exclusive distribution of the published version of the journal (e.g., submit to an institutional repository or publish in a book), with an acknowledgment of the original publication in this Journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their websites) before and during the submission process, as it can lead to productive exchanges, as well as citations of previously published work.

Each author is expected to complete the copyright process with a document of the originality of the manuscript, the templated document is below:

7.png)

6.png)

2.png)